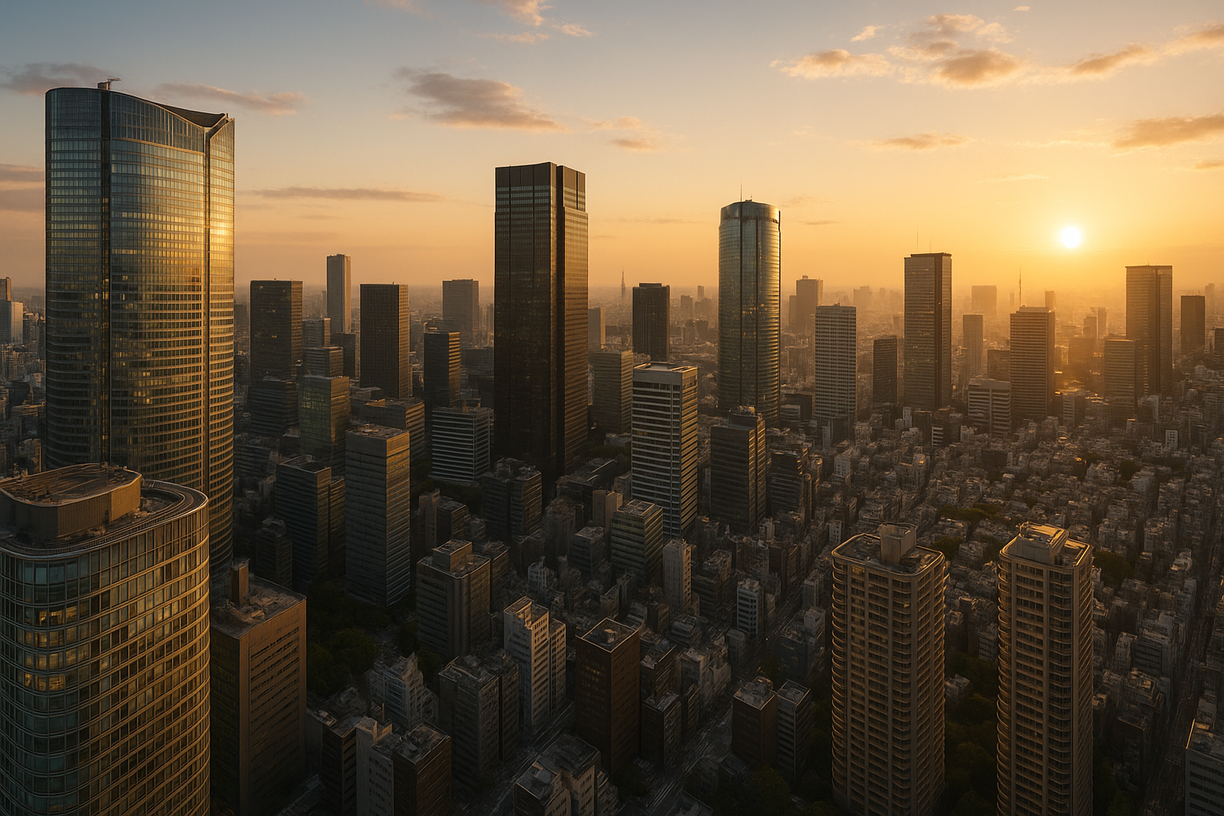

Tokyo Luxury Apartment Market: 2025 Trends and Insights

Comprehensive analysis of Tokyo's luxury apartment market trends, pricing, and investment opportunities in 2025.

Tokyo Luxury Apartment Market: 2025 Trends and Insights

The Tokyo luxury apartment market continues to demonstrate exceptional strength in 2025, with record-breaking prices and unprecedented international investment. This comprehensive analysis examines the latest market dynamics, pricing trends, and investment opportunities based on Q1 2025 data and expert forecasts.

Market Overview: Record Performance in 2025

Tokyo's luxury apartment market has reached new heights in 2025, with several key developments reshaping the landscape:

Key Market Statistics (Q1 2025)

- Average luxury apartment prices: ¥2.6 million per square meter in prime locations

- Year-over-year growth: 5-6% price appreciation projected for 2025

- Ultra-high-end segment: 72% surge in ¥100+ million condominiums

- Foreign investment: Comprises 27% of total transactions, up from 21% five years ago

- Average new condominium price: Over ¥110 million (~$800,000) in Tokyo's 23 wards

- Central Tokyo average: Exceeds ¥100 million per unit

Foreign Investment Driving Luxury Demand

International Buyer Impact

The weak yen continues to attract overseas investors, with the currency hovering around multi-decade lows against the dollar in early 2025. This has made Tokyo property comparatively affordable by global standards, particularly for international buyers.

Key Foreign Investment Trends:

- Asian buyers: Account for approximately 20% of luxury condo purchases in central Tokyo

- Investment growth: Foreign residential asset investment rose 18% YoY to JPY 740 billion ($5 billion USD) in 2024

- Market share: Foreign investment now represents 27% of total real estate transactions

Prime Luxury Locations: Price Analysis

Shibuya & Shinagawa Districts

Premium luxury apartments routinely exceed ¥2 million per square meter, with some exceptional units commanding over ¥2,600,000 per square meter. This reflects intense demand from both domestic and international ultra-high-net-worth individuals.

Ginza & Marunouchi

These traditional luxury bastions maintain their status as Tokyo's most prestigious addresses, with penthouse units in marquee projects reaching ¥1 billion.

Roppongi Hills

Continues to attract international residents seeking cosmopolitan luxury living with world-class amenities and services.

Supply Constraints Fuel Price Growth

Critical Supply Shortage

A severe supply shortage is driving market dynamics:

- New apartment releases: Projected to decline 17% to 22,239 units in fiscal 2024

- Historical context: Represents the lowest supply level since 1973

- Luxury rental surge: Mid-market asking rents increased 6.4% YoY in Q4 2024

Investment Outlook for 2025-2026

Positive Factors

Market Challenges

- Rising Interest Rates: Bank of Japan signaling gradual shift from ultra-low rates

- Premium Valuations: Properties priced over ¥60 million forecast for 6-7% growth in 2025

- Affordability Concerns: Record prices challenging local buyer participation

2026 Market Predictions

Based on comprehensive market analysis, we anticipate:

- Continued appreciation: 4-5% annual growth in prime luxury locations

- Sustainability focus: Increased demand for eco-friendly and smart home features

- Flexible living spaces: Growing preference for adaptable luxury environments

- Enhanced services: Premium concierge and lifestyle amenities becoming standard

Investment Strategy Recommendations

For International Investors

- Target ultra-prime locations: Focus on Ginza, Roppongi, and Shibuya districts

- Currency timing: Leverage favorable exchange rate environment

- Professional guidance: Essential due to complex Japanese real estate regulations

For Luxury Buyers

Properties exceeding ¥60 million offer the strongest appreciation potential, with forecasted 6-7% value growth in 2025.

Conclusion

The Tokyo luxury apartment market in 2025 represents one of the world's most dynamic and opportunity-rich real estate environments. With record foreign investment, severe supply constraints, and sustained demand from global UHNW individuals, the market offers compelling opportunities despite premium valuations.

The combination of Japan's economic stability, Tokyo's world-class infrastructure, and the continued weakness of the yen creates an exceptional investment environment for luxury real estate in 2025.

For exclusive access to Tokyo's premier luxury developments and personalized investment strategies, contact our specialized luxury real estate team.